| Updates in Forex |

|

Quantina Intelligence Ltd.

Quantina Announces Important Update On NewsTrader v3.1 Ultimate EA Following New Changes In ForexFactory Calendar System

The

makers of the renowned news trading EA and other prolific Forex trading

system announced yesterday 7th March, 2017 important updates in their

NewsTrader Ultimate EA.

The

EA automatically trades the news by using data (results of events) from

the economic news calendar derived from Forex Factory to place BUY/SELL

orders on the chart.

The

update became extremely necessary because the EA, which relied on the data

pulled from Forex Factory calendar to draw up schedules, filter economic

news events and most importantly make trade decisions from the results

of the event, could no longer do so after Forex Factory updated their calendar system.

The good news is that the new EA, version 3.19, has been fine tuned to download the news, and has a few minor visual fix.

You can download the product by logging into your account on Quantina's Website,

going to My Account and selecting the Downloads section. If you are

having trouble finding the files, you can send an email to their

technical support.

NB

The

£25.00 promo for all Quantina Products is no longer available. But you

can still get any of their products including the newly updated NewsTrader Ultimate EA at 50% discount by using this Coupon Code during checkout: VIPxcOnyeB

|

|

FXCM Fined By CFTC

CFTC

Orders Forex Capital Markets, LLC (FXCM), Its Parent Company, FXCM

Holdings, LLC and FXCM’s Founding Partners, Dror Niv and William Ahdout,

to Pay a $7 Million Penalty for FXCM’s Defrauding of Retail Forex

Customers

Press

statements from the regulator as at February 6th 2017 has it that FXCM

was fined for infractions bordering on false statments or misleading

information which must have affected traders. This news comes as big

blow to FXCM and a shock to the Forex Community.

See excerpts below from the regulator.

FXCM,

Niv, and Ahdout are Prohibited from Registering with the CFTC, Acting

in Exempt Capacities or Acting as Principals, Agents, Officers or

Employees of Registrants

CFTC’s Order also holds FXCM, Niv, and FXCM Holdings responsible for FXCM’s False Statements to the National Futures Association

Washington,

DC – The U.S. Commodity Futures Trading Commission (CFTC) today issued

an Order filing and settling charges against Forex Capital Markets, LLC

(FXCM) , its parent company, FXCM Holdings, LLC (FXCM Holdings), and two

founding partners, Dror (“Drew”) Niv, and William Ahdout, who were,

respectively, Chief Executive Officer of FXCM and Managing Director of

FXCM, (collectively, Respondents). FXCM’s principal place of business is

New York, New York; Niv resides in Connecticut; and Ahdout resides in

New York.

The CFTC Order finds that, between September 4, 2009

though at least 2014 (the Relevant Period), FXCM engaged in false and

misleading solicitations of FXCM’s retail foreign exchange (forex)

customers by concealing its relationship with its most important market

maker and by misrepresenting that its “No Dealing Desk” platform had no

conflicts of interest with its customers. The Order finds FXCM, FXCM

Holdings, and Niv responsible for FXCM making false statements to the

National Futures Association (NFA) about its relationship with the

market maker.

The Order requires Respondents jointly and

severally to pay a $7 million civil monetary penalty and to cease and

desist from further violations of the Commodity Exchange Act and CFTC

Regulations, as charged. FXCM, Niv, and Ahdout agree to withdraw from

CFTC registration; never to seek to register with the CFTC; and never to

act in any capacity requiring registration or exemption from

registration, or act as a principal, agent, officer, or employee of any

person that is registered, required to be registered, or exempted from

registration with the CFTC.

“The CFTC Is Committed to Protecting Customers from Harm in the Markets It Regulates”

“Full

and truthful disclosure to customers and honest discourse with

self-regulatory organizations such as NFA are vital to the integrity and

oversight of our markets,” said Gretchen L. Lowe, Principal Deputy

Director and Chief Counsel of the CFTC’s Division of Enforcement.

“Today’s action’s demonstrates that the CFTC is committed to protecting

customers from harm in the markets it regulates.”

FXCM is

registered with the CFTC as a Futures Commission Merchant and Retail

Foreign Exchange Dealer. FXCM has been providing retail customers with

access to over-the-counter forex markets through a proprietary

technology platform and has acted as counterparty in transactions with

its retail customers in which customers can buy one currency and

simultaneously sell another. Both Niv and Ahdout were CFTC registrants

during the relevant period.

FXCM, under Niv’s and Ahdout’s

direction and control, misrepresented to its retail forex customers that

when they traded forex on FXCM’s No Dealing Desk platform, FXCM would

have no conflict of interest, the Order finds. In addition, according to

FXCM’s marketing campaign, retail customers’ profits or losses would

have no impact on FXCM’s bottom line, because FXCM’s role in the

customers’ trades was merely that of a credit intermediary, the Order

finds. FXCM further represented that the risk would be borne by banks

and other independent “market makers” that provided liquidity to the

platform, according to the Order.

FXCM’s Undisclosed Interest

Contrary

to these representations, the Order finds, FXCM had an undisclosed

interest in the market maker that consistently “won” the largest share

of FXCM’s trading volume – and thus was taking positions opposite FXCM’s

retail customers. FXCM, the Order finds, formulated a plan in 2009 to

create an algorithmic trading system, using an FXCM computer program

that could make markets to FXCM’s customers, and thereby either replace

or compete with the independent market makers on FXCM’s “No Dealing

Desk” platform. Although FXCM eventually spun off the algorithmic

trading system as a new company, in actuality the company remained

closely aligned with FXCM, according to the Order. This market maker

received special trading privileges, benefitted from a no-interest loan

provided by FXCM, worked out of FXCM’s offices, and used FXCM employees

to conduct its business, the Order further finds.

The Order finds

that FXCM and the market maker agreed that the market maker would

rebate to FXCM approximately 70 percent of its revenue from trading on

FXCM’s retail forex platform. In total, through monthly payments from

2010 through 2014, the company rebated to FXCM approximately $77 million

of the revenue it achieved. However, FXCM did not disclose to

customers, among other things, that this company – FXCM’s principal

market maker – was a startup firm spun off from FXCM, the Order further

finds.

False Statements to the NFA

The Order also finds

that FXCM willfully made false statements to NFA in order to conceal

FXCM’s role in the creation of its principal market maker as well as the

fact that the market maker’s owner had been an FXCM employee and

managing director. The Order finds that during a meeting between NFA

compliance staff and FXCM executives, Niv omitted to mention to NFA the

details of FXCM’s relationship with the market maker.

The Order

holds Niv and Ahdout liable for FXCM’s fraud violations as “controlling

persons” who were responsible, directly or indirectly, for FXCM’s

violations. Niv is also held liable for FXCM’s false statements to NFA

as a controlling person who was responsible directly or indirectly for

those violations. FXCM Holdings is held liable for FXCM’s fraud and

false statement violations as principal of FXCM, the Order also finds.

The CFTC thanks NFA for its assistance in this matter.

CFTC

Division of Enforcement staff members responsible for this action are

Christopher Giglio, Patrick Daly, David C. Newman, Xavier Romeu-Matta,

K. Brent Tomer, Lenel Hickson, Jr., and Manal M. Sultan.

Media Contact

Dennis Holden

202-418-5088

|

A High Profile Forex Institution Is Looking For Talented Traders

Get Paid To Trade....

Do you:

-Want to make a living from your trading or help others while remaining anonymous and avoid dealing directly with clients?

-Enjoy teaching others how to trade?

-Have an in depth understanding of both fundamental and technical analysis?

There are a few things to consider and in order to qualify it’s not all

about your returns but how you manage and quantify the risk you take.

Terms of Qualification

- Real money trading account

- Fully verified track record on Myfxbook

- At least $5,000 USD in your trading account

- At least a 4-month track record

- At least 200 realised trades

- No Grid or Martingale - this includes averaging into trades

- Automated or Manual traders welcome* (If Automated provide back-tested results.

If Manual you will be required to illustrate some setups in out of sample data.)

- Average trade holding time must be below 1 week and above 5 minutes

If you meet the above criteria and you think you've got what it takes then send the following details below to (onyeobike@yahoo.com or onyeobike@gmail.com):

1. Name

2. Link to your Trading Account or Trade

Records (Myfxbook, MT4i preferable)

3. Email Address & any other contact address

Applicants will be screened by the Forex Institution making the announcement.

This is an opportunity to change your life and work within one

of the few authentic, reputable and growing organizations in the Forex

industry.

|

FOREX TESTER LAUNCHES VERSION 3

Key Features & Comparison Between Version 2 & Version 3

14/09/2016 - The makers of the renowned Forex Simulating Application (Forex Tester) for Strategy Building & Backtesting recently launched a newer version with outstanding features and improvements.

The

app comes with over 26 new features and improvements which makes it

much more efficient, and robust for Forex trading strategy development

and testing.

| Feature |

Forex Tester 2 |

Forex Tester 3 |

|---|

| Simplified mode system |

History + Testing modes |

One aggregate mode |

| Automated ticks generation |

Uses 1 core of your PC’s processor |

Utilizes all processor’s cores for speeding up the testing |

| Keep all testing parameters in the projects |

Time consuming five-step process |

One-step process |

| Number of simultaneous currency pairs for downloading |

1 pair at a time |

Any number of pairs at a time |

| Increased data downloading and processing speed |

Single-threaded data downloading |

Multi-threaded data downloading |

| Profile (desktop) saving |

|

|

| Smart Profit Chart for analyzing of the strategy’s performance |

Only main features |

Features to perform detailed analysis |

| Automated time shift for all of the project's currency pairs |

|

|

| Number of built-in EAs for automated testing |

1 |

Three for now. But users of Forex Tester 3 will have more EAs soon |

| Instantaneous changing of the pending orders, stop loss and take profit values with a drag & drop |

- |

Save time on orders’ installation |

| Use the software on multiple monitors |

|

Any number of monitors

|

| New more user-friendly software registration scheme |

- |

Faster and easier |

| Renko bars |

|

|

| Organizing of the workspace based on preferences |

- |

New doc-interface where you can detach, merge and move any window or tab |

| Shows real number of ticks |

Not always |

Always |

| Hotkeys for all the functions |

Only preset hotkeys |

Assign custom hotkeys to any functions |

| New graphical tools for analysis and chart markup |

Lines, waves, Fibo, shapes |

Lines, waves, Fibo, shapes + signs, thumbs up & down, arrows, price labels |

| Other user interface improvements |

- |

7 |

| Accelerated testing process |

- |

Software works faster with the same computer capabilities |

| Comments |

|

Add comments to the orders for further more quickly finding and analyzing |

| Undo most of long-term operations (especially useful when downloading data from the server) |

- |

Allows to instantaneously correct mistakes |

| List of objects |

- |

Simplified access to the search, editing and deleting of the graphical objects |

For indepth desscription of each feature please visit website - Forex Tester 3 In-depth Feature Description

The new version would be released on September 15th, 2016. FREE Upgrade from Version 2 to Version 3 is available at a limited time. See our homepage for more details.

|

|

HOTFOREX EXCLUSIVE PROMO

HotForex Relaxes Minimum Requirement For PAMM Manager Account

29/07/2016 - HotForex Broker

has announced an upcoming promo that will allow new & existing

traders plus PAMM Managers to open a PAMM Manager Account with funds as

low as $300.00 as from August 1st 2016

Prior

to this announcement the minimum requirement to open a PAMM Manager

Account was around $500.00. The benefit of this promo is that traders

who are that good with low income trading strategy like cents can now

have the opportunity to become Fund Managers.

The

PAMM system is one of the viable ways of making more income in addition

to your personal trading income through client funds traded by the PAMM

Manager. The PAMM Manager earns a success fee and as well a penalty fee

from clients registered under the account.

Core Benefits

1. Expand your portfolio while utilizing less fund

2. Access to a wide pool of funds

3. As much as 6 accounts can be opened by the Fund Manager

4. Open access to all traders who are desirous of earning more income from their trading skills

5. Opportunity to boost trading performance in order to rise up in rankings and draw additional investors.

6. Does not requirement any other cost.

Requirements

You need to open a myhotforex account first (for new traders) and then go on with the process for opening the PAMM Manager Account.

For more information and details about Hotforex PAMM and promo please visit website: HotForex Exclusive Promo For PAMM Managers or Contact us: FXTradeCity

NB: Promo starts August 1st 2016 and runs for a limited time. 1. Expand your portfolio while utilizing less fund

2. Access to a wide pool of funds

3. As much as 6 accounts can be opened by the Fund Manager

4. Open access to all traders who are desirous of earning more income from their trading skills

5. Opportunity to boost trading performance in order to rise up in rankings and draw additional investors.

6. Does not requirement any other cost.

Requirements

You need to open a myhotforex account first (for new traders) and then go on with the process for opening the PAMM Manager Account.

For more information and details about Hotforex PAMM and promo please visit website: HotForex Exclusive Promo For PAMM Managers or Contact us: FXTradeCity

NB: Promo starts August 1st 2016 and runs for a limited time.

|

Quantina Intelligence Forex Research Lab Launches

3 New Spectacular EAs

05/05/2016 - A couple of weeks ago, the makers of the renowned News Trading EA - Quantina News Trader Ultimate, released more spectacular Expert Advisers from their lab. Although one of the EA was released some couple of weeks ago, and the other two are fresh out of the Lab. An outstanding quality about Quantina Intelligence Research Lab is their continuous research, and development of news trading systems as well as other automated trading software.

The Three New EAs

New Release #1.

|

| £290.00 |

Quantina seems to have finally joined other developers of Auto Click News Trading EAs. The EA works like a spike-trading

tool that analyzes MULTIPLE Forex Economic News Data and generates

trades by your predefined conditions in seamless lightning speed.

The EA automatically execute trades for you, based on the difference

between the actual and expected (or customized) macroeconomic data. If

data is positive (higher than expected) it can automatically enter the

buy order on the market. If data is negative (lower than expected) it

can automatically enter the sell order on the market by mouse click

emulator.

Key Features

Stand Alone Application: No

need to install it, one single file only. It doesn’t make any changes

in registry and it doesn’t use FTP protocol. Compatible with any PC or

VPS. As a stand-alone application give your trading platform a freedom

and huge trading advantage.

Most Advanced Coding Method: It’s coded to consume less computer resources, hence It has a faster execution and stable operation.

Avoids Multiple News Indicator conflict: The Developers

realized that one single economic news release can not give us a

correct trading direction if at the same time releasing several

different economic data on the market. If there are conflict in the deviation then the market could be highly volatile and unpredictable.

|

| News Spike - US Interest Rate 16th March, 2016 |

Integrated MND Core (Multiple News Decision Core): A special core

(Multiple News Decision Core) was designed to provide additional

advantages during news trading. With MND core you will able to add

multiple news events with different conditions to a single Intelligence

(trading decision). Quantina Intelligence News System can process

multiple indicators.

User-friendly Interface - Instant Trading Signal: You can choose

any news event from a simple Economic Calendar on our interface. Set

your conditions easily as a simple form. Add it to your Intelligence and

set up click co-ordinates on your broker’s BUY or SELL button.

Activate it with one click. No need to understand scripts or any

programming language.

Trades Every News Impact Types: Not

just all the most important economic indicators such as US NonFarm

Payroll, Unemployment Rate, or Inflation reports can be traded, but

every high, medium, and low impact news events from almost 42 countries can be traded. Unlimited opportunities and trading rules can change everything.

After News Auto Click Delay:

Instant Auto Click and After News Auto Click method also can be used in

this version. Customizable After News Auto click can delay your trades

for the beginning of next timeframe to avoid - high spread and -

volatile market conditions. Delay valid for the scheduled time and not

for the news released. In this case you will have extra advantage for

trading opportunity.

Fast-Link To Get More Info: There is a built-in get more information link for every economic news event, which is sourced from Investing.com. The information contains

the type of news event, history data with charts, and also a simple

explanation for beginners regarding how the actual data will affect the

currency (e.g. “A

higher than expected reading should be taken as positive/bullish for

the GBP, while a lower than expected reading should be taken as

negative/bearish for the GBP.”)

Designed For All Kind of Users: The EA was made by professionals

and also tested on beginners to ensure it is optimized for all kind of

users. Ideal for technical and fundamental trades.

Other Features

- Broker friendly & works on any trading platform

(MetaTrader 4/5, cTrader, JForex…)

- Works on any VPS

- After News Clicking Trading Method developed by Quantina

- Can read multiple economic indicators for better decision and Conflict Protection System

- Built-in fast link for our community to instant help

Additional Notes

- Price - £290.00

- There is no any upfront cost or activation fee for now.

- Limited Time Offer. The EA will not be available after meeting the number of sales that the server can sustain.

- Rent or one-time off purchase

- For special discounts please contact us

For more information visit website - Quantina Intelligence Auto Click News Trader 2016 v1.5

New Release #2.

The Quantina Forex News Trading Pack + Remote Installation is a special combination of Qunatina's best EAs inclusive of a special installation by their technical team on your PC, VPS, or Server. One of the key advantage of acquring the combination pack is the significant price difference when compared to buying each of the EAs alone. Moreover the EAs are one of the best with proven profitability. So the combination would increases the chances of more profits. Also the installation of the EAs by Quantina Technical Team is another good adavantage since they will apply the same techniques and parameters they use on their production system in installing the pack on your PC or VPS.

Price Details & Economic Advantage

| S/N |

Stand Alone EA + Accessories |

Price |

| 1 |

Forex News Trader EA v3.1 - Ultimate |

£190.00 |

2

|

Forex News Trader - 4 Recommended & Tested Settings + Detailed Manual Guide in .PDF file |

£29.00 |

| 3 |

After News Trader EA 2016 |

£90.00 |

| 4 |

After News Trader EA – Settings pack for manual and auto + detailed manual guide in .PDF file |

£19.00 |

| 5 |

Straddle Trader EA 2016 with Latency Meter |

£19.00 |

| 6 |

Straddle Trader EA – Settings pack for special news + Detailed Manual Guide in .PDF file |

£9.00 |

| 7 |

Video

Instructions for settings and strategies, 24/7 Technical Support by

email (response in 48hours), access to our community and Forum site for

quick help, + remote installation by a highly trained Technical Team.

Remote

installation service includes to check your PC’s hardware and software

requirements before installing. Also includes the proper installation,

pre-test and a short technical advise for better performance |

£60.00 |

|

Total (1 - 8) |

£416.00 |

| Quantina Forex News Trading Pack (Combination of 1 - 8) & save £167 |

£249.00 |

For more information please visit website -Quantina Forex News Trading Pack (Including Remote Installation)

Special discounts please Contact Us

New Release #3.

This new EA is really an intelligent design by Quantina. As the name implies, it trades after the news release has occurred after following a very clever logic that scans the market for opportunities of a price reversal, which is very common in news events, and then takes advantage of it. This new EA is really an intelligent design by Quantina. As the name implies, it trades after the news release has occurred after following a very clever logic that scans the market for opportunities of a price reversal, which is very common in news events, and then takes advantage of it.

How It Works

After

a high or medium impact news events, the FOREX market will react and

price will certainly move in one direction (long or short). The EA will

wait until the end of the timeframe before it enters the market. This protects you from high spread, and latency issues.

The EA works with

market orders to reduce data usage with your broker server. It can

observe the candle of a scheduled news event and open trades in the same

and/or opposite trend direction beginning of the very next candle.

Depending on the size of impact and direction, it will track and secure

your executed order with the BreakEven method* and Trailing Stop as

usual in Quantina Expert Advisors.

|

Screenshot of EUR/USD H1 Timeframe - News event at 15:00 server time

Observed candle was a Bearish candle; in that case, the EA opened a

Sell (short) trade at the next candle at 16:00. (TimeFrame is H1). Then

closed the trade using Break Even and Trailing Stop method with some

profit. |

|

Screenshot: EUR/USD M1 Timeframe - News Event at 4:15 as MT4 terminal

EA entered the market at 4:15 + 1 Candle

(4:16) on M1 Timeframe. Profit Protection Sysytem will automatically

start tracking your trade.

|

|

Example of an Opposite Trade direction: Screenshot: EUR/USD H1

News Event: Medium Impact at 07:15a.m. (server time) Opposite Trade Direction = true

Observed

Candle was Bullish. In that case EA will open an opposite trade

direction = Sell (short) trade instead of buy trade. Opposite tarde

direction is recommended for medium impact of news events. |

key Features

1. 4/5 digit platform supported automatically

2. Real ECN / STP account type compatible

3. Latest MT4 build 950+ compatible

4. Advanced Break Even Method (Trigger + Lock)

5. Opposite Trade Direction for medium impacts

6. Trail before break even available

7. Separated Buy and Sell Order Distance

8. Intelligent Money Manager (Calculated with Stop-Loss)

9. High Spread Protection

10. Settings can be used in PIPS or in Points

11. Stealth Mode Function to protect your account

Price - £90.00

Purchase For One Time Payment or Rent Monthly

|

FXTradeCity In Conjunction With Quantina Intelligence Forex Research Lab Presents

Yuletide Promotion (50% Discount)

On All Quantina Forex Intelligence Products

FXTradeCity is glad to announce its 50% Discount promotion on all Quantina Intelligence Products in this season of celebration. This means friends, visitors and fans of FXTradeCity will get all products on Quantina Intelligence website for Discount of 50% cost price until the expiration of the promotion.

Benefits

Quantina Forex News Trader EA 2015 ULTIMATE v3.1 (Automated-and-Manual Trade) - See more details of the EA

Cost Price: £190.00

50% Discount: £95

Quantina Forex News Trader EA 2015 DEMO v3.1 (Automated and Manual)

See more details of the EA

Cost Price: £29.00

50% Discount: £14.50

Quantina Intelligence iTrend EA 2015

Universal Edition v1.5

See more details of the EA

Cost Price: £99.00

50% Discount: £49.50

Quantina Intelligence Session Trader EA 2015

Universal Edition

See more details of the EA

Cost Price: £29.90

50% Discount: £14.95

Quantina

Straddle Trader EA 2016 (With Latency Meter) Half Automated Trading

System with high spread- and profit protection system. See more details of the EA - **Available for ONLY existing cutomers

Cost Price: £19.00 50% Discount: £9.50

......and many more products (indicators, special settings packs, e.t.c.).

To take advantage of this offer use the Coupon Code: VIPxcOnyeB at check out during payment for any product on Quantina's website.

We strongly recommend deploying your news trading EAs on a VPS in order to avoid missing any trade. NextPointHost is a very good VPS Provider offering up to 25% additional lifetime discount depending on the billing cycle. We learnt a new data centre will soon be launched in London amongst other data centres in Europe. See more details: NextPointHost Forex VPS Hosting

Wish you a pipful encounter trading the news. Quantina

Straddle Trader EA 2016 (With Latency Meter) Half Automated Trading

System with high spread- and profit protection system. See more details of the EA - **Available for ONLY existing cutomers

Cost Price: £19.00 50% Discount: £9.50

......and many more products (indicators, special settings packs, e.t.c.).

To take advantage of this offer use the Coupon Code: VIPxcOnyeB at check out during payment for any product on Quantina's website.

We strongly recommend deploying your news trading EAs on a VPS in order to avoid missing any trade. NextPointHost is a very good VPS Provider offering up to 25% additional lifetime discount depending on the billing cycle. We learnt a new data centre will soon be launched in London amongst other data centres in Europe. See more details: NextPointHost Forex VPS Hosting

Wish you a pipful encounter trading the news.

|

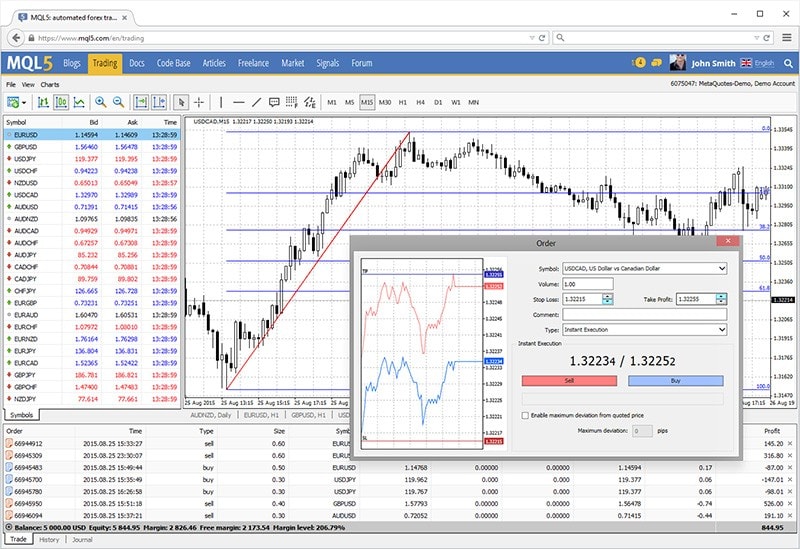

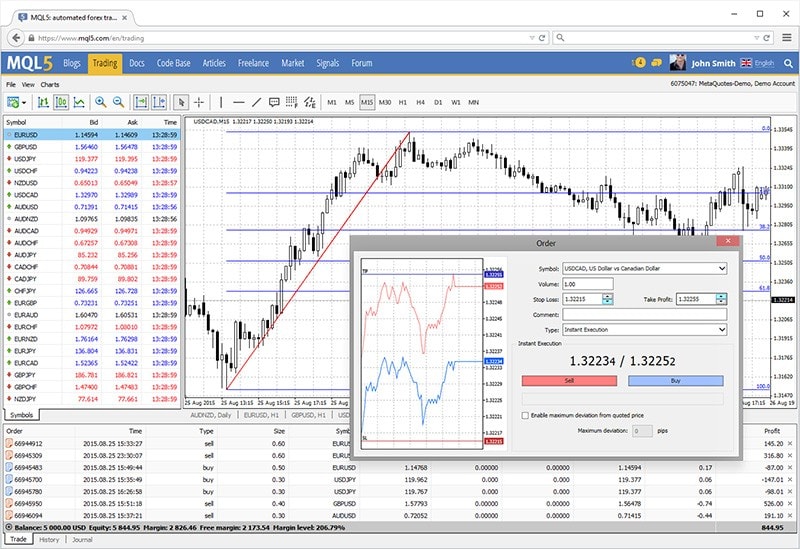

Metaquotes Software Corp Launches MetaTrader 4 Web Platform - Beta Edition on Browsers

The makers of MT4 officially announced the launching of a web based MT4 platform on browsers. The news which was posted on 31st August, 2015 in the official website states that users can utilize the platform via any browser and

operating system (Windows, Mac, Linux). No additional software is

required — everything is done on the MQL5.community website.

The only requirements needed to get started is to register for an MQL5.community account and a demo account on the MetaQuotes-Demo server.

The

platform is not limited to only Metaquotes demo servers, because

traders can still register their broker name, and login in to their

accounts. Click this link to add a trading account: https://www.mql5.com/en/trading

This

innovation breaks the barrier of standalone platforms which restricts

traders to their PCs. Now traders can get access to their platform

everywhere, anywhere as long as a browser is there.

The

platform is not limited to only Metaquotes demo servers, because

traders can still register their broker name, and login in to their

accounts. Click this link to add a trading account: https://www.mql5.com/en/trading

This

innovation breaks the barrier of standalone platforms which restricts

traders to their PCs. Now traders can get access to their platform

everywhere, anywhere as long as a browser is there.

|

Forex21 Launches Update of FXPulse 4.0

The makers of the renowned Forex Insider Indicator, PowerFlow EA & ProFX recently launched the updated version of FXPulse Tool. The

utility, which aids news trading by providing news events directly on

the chart makes it the fourth major update since inception.

A major feature in the new version is the multilingual interface & faster delivery of news events directly on the chart.

Key Features

- Automatic updates of news events

- Currently supports English, German, Russian, Spanish, French, Italian, Japanese, Chinese, Hungarian, Polish, Indonesian.

- Fast news stream

- Robust filtering function. Filter events that should display, alert, e.t.c.

Once more the utility comes FREE with no conditions.

Statement from the developers: "News is the lifeblood of the Forex Market! Did

you ever find yourself in a trade where everything seemed to be perfect

but suddenly the price turned within seconds against your position and

your profitable trade turned into a huge loss?

If yes, surprise “You got strucked by Forex News”.

Experienced

currency traders know that keeping an eye on Forex News and Economic

Data is essential because there is nothing what can turn prices as quick

as News do. And so should you."

Click here to visit Forex21 and download FXPulse4.0

Additional Download: Forex Insider (FREE)

|

NextPointHost

Forex VPS & Hosting Solutions Celebrates 5

Years Anniversary With Special Discount Offers & A Special

Birthday Draw

NextPointHost

Forex VPS & Hosting Solutions Celebrates 5

Years Anniversary With Special Discount Offers & A Special

Birthday Draw

NextPointHost recently announced Discounted Prices and a Special Birthday Draw For Their 5th Anniversary - Tuesday, May 5, 2015

NextPointHost,

a premier provider of affordable and VPS hosting, announced it is

marking its 5th anniversary by announcing a couple of special discounts

to help celebrate five years of offering world-class web hosting

services to customers in Europe and internationally.

In celebration of its 5-year anniversary, the company has announced discounts on two of the most popular hosting services – shared and VPS SSD servers - offering new and existing customers 50% off all new orders placed before 20th May 2015.

NextPointHost will also be giving away a Free SSD VPS Hosting account for 1 year.

Anyone can take part in the Birthday Draw just by visiting their

Facebook page and submitting the application form for a chance to win.

Having started with just three Forex VPS hosting plans in 2010, NextPointHost’s

service portfolio has grown and adapted over the past 5 years to

include products under 6 different categories and catering to businesses

of all sizes. In fact much of the past 5 years at NextPointHost has been spent on tweaking and perfecting their hosting solutions.

The

company has already exhibited phenomenal success in the market.

“NextPointHost’s 5th anniversary is a significant milestone in an

industry that is changing constantly, said Genko Penev, CEO of NextPointHost. “A long-term focus on customer care and a stable operations have greatly contributed to NextPointHost’s

success. We now have two datacenters, and a range of hosting products

far more powerful than anything I could have imagined back in 2010.”

To find out more about the 50% discount on shared and VPS hosting servers, and other promotions and services please visit: NextPointHost Website

NB

NextPointHost ranks No.1 in our Top 5 Forex VPS Providers. See our VPS Table: Top 5 Forex VPS Proiders

|

CFTC

Launches Online Tool That Helps Investors To Check The Registration,

License, & Disciplinary History Of Certain Financial

Professionals.

The

US Commodity Futures Trading Commission (CFTC) recently launched a

SmartCheck tool that allows investors to verify the credentials of

investment professionals, uncover any past disciplinary history, and

stay ahead of scam artists with news and alerts. The

investigative tool exposes Six (6) key information which reveals the

true background of a registered financial professional or institution.

KEY DETAILS/FEATURES

- Background Affiliation Status Information Center (BASIC): Find out if your financial professional is registered or has a history with the CFTC or NFA.

- Broker Check: See whether your broker is registered or has a history with FINRA or the SEC.

- CFTC Disciplinary History:

Displays a repository of the agency’s active investigations, and past

violations. See if your broker has a displinary action filed with CFTC.

- The Securities and Exchange Commission Investment Advisor Public Disclosure (IAPD): Simply displays active registration of an investment adviser by reviewing the information available following the "Registration Status" hyperlink on IAPD.

- Internet Search: Search for public disciplinary records or even public commentary and reviews about financial professionals.

- Sundry Resources:

Information on The Securities and Exchange Commission EDGAR Database,

National Association of Insurance Commissioners, North American

Securities Administrators Association, National Association of State

Boards of Accountancy, FINRA Professional Designation Lookup, &

Municipal Securities Rulemaking Board Education Center

For more information visit CFTC SmartCheck Website

|

HotForex Launches Social Traders Network

HotForex recently announced the launch of the much awaited Social Media Trading Network, which

connects more than 250,000 traders across the world. The innovative

scheme allows traders in the network to Identify, follow and copy the

most

successful traders; build portfolio; exchange information; and,

track progress.

The

social trading platform, which is powered by one of the fastest growing

network in the world FXStat is also available on mobile Smartphones. So

traders can keep up-to-date with the latest news, and react to market moves as they happen anywhere anytime.

KEY FEATURES The

social trading platform, which is powered by one of the fastest growing

network in the world FXStat is also available on mobile Smartphones. So

traders can keep up-to-date with the latest news, and react to market moves as they happen anywhere anytime.

KEY FEATURES

- Connect with other traders & share strategies and discuss breaking news

- Identify more trading opportunities by following the traders that interest you the most

- Copy

the most successful manual and algorithmic traders, while you build a

portfolio of winning strategies and copy trades automatically

- React to market changes on-the-go on your iOS or Android mobile devices

- Improves your success by diversifying your investment and reduces risk

HOW TO GET CONNECTED

- Login to myHotForex

- Click Accounts > Open Account, Select ‘Social’ from the Account Type Menu and complete the short form.

- Click ‘Submit’

BENEFITS FOR NEW CLIENTS

New clients who open an account through FXTradeCity would be given a special COUPON code to purchase Quantina News Trader EA Ultimate 2015 at £90.00 OFF the cost price. To open an account through us Click Here: HotForex - FXTradeCity (offer lasts until 31st March, 2015)

|

| Lower The Cost Of Your Trading With HotForex Zero Spread Account |

For more information visit HotForex Website: HotForex Social Trading Network

|

MetaQuotes Launches Renting of Robots & Market Products on MQL Market Place

MetaQuotes the developers of MetaTrader 4 & MetaTrader 5 has innovated a scheme, which enables RENTING of EAs, & Forex Products from the MQL Community.

This innovation according to MetaQuotes allows members not only to buy

MetaTrader Market applications but also rent them. According to the

developers, "Renting a product is clearly much cheaper than purchasing a full license".

Part

of the objectives of this scheme is to build trader's confidence about a

product before buying it. This action might gradually eradicate demo

versions as a product can be rented for a certain period of time to make

sure that it is really what you need - much like the same objective for

a demo version with limited features.

Developers

of Forex systems have a lot to benefit through this scheme as more

clients would be attracted to cheaper prices with contractual duration.

MT4 ISSUES & LIVE UPDATE SOLUTION

Currently

this scheme does not work for MT4 build 765 and below. However it works

perfectly for MT4 latest build 777 upwards but unfortunately the new

build is not available through live update on MT4 platform.

To perform an alternative live update to build 777 or 778 follow the steps below:

- In

MT4, go to open a new account in the file menu. When it brings up a

list of servers, click to add a new server and just type in metaquotes.

It will then scan and find the metaquotes demo server.

- Open a new demo account and log in.

- Check

the journal tab for a message "Live Update Available" The platform

begins the update at the background. You will not get any message

informing you that the update is complete. But 10 to 20 minutes should

be more than enough for the update to be completed depending on your connection speed.

- Restart the platform.

- When the platform restarts, it will automatically shut down for some seconds to complete the update and then come up by itself.

- To confirm if the update was completed successfully, go to Help, and click About. You should see the new version build.

- You can login back to your former trading account after this process.

For more information visit MetaQuotes Website: Rent Market Products And Save Your Money

|

FOREX INSIDER

Forex21 Releases New FREE Institutional Tool

That Displays Live Trading Positions Of Other Traders, Trading Data

From MyFXBookAPI, Real Traded Volume Of Currencies, e.t.c....

Forex21 announced the release of a high end FREE institutional trading tool that allows ordinary retail traders to see positions of other traders, which will help to guide their trading decisions.

According to the designers of this wonderful utility, only institutional traders had access to such data which gave

them a serious advantage over retail traders because of obvious

reasons. With Forex Insider, traders can now know what other

traders are doing which makes it easy to beat them on the Forex

battlefield.

Features:

- Live Data from MyFXBook API

- Information on more than 70 Forex Symbols

- Shows real traded volumes in the market

- Data displayed on the chart comes from Community Outlook section and

is based on up to 100 000 live trading positions and includes the

following information:

- Short vs. Long - Positions Ratio in Percent

- Short vs. Long - Positions Volume

- Short vs. Long - Number of Positions

- Average Short Price

- Average Long Price

- Average Long/Short Prices as Levels

- As the data is updated every 60 seconds, the information provided by

Forex Insider gives you a unique insight of what other currency traders

are doing. The result is a strategic advantage which allows the user to

stay away from risky trades and pick trades with high win probability.

|

| Display on Forex Chart |

The information displayed on your chart is based on thousands of live trading

operations, the tool gives you a deep and accurate insight of what other

traders are doing.

Price:

FREE (Only available for a limited time!)

Download:

Click Here: Forex Insider - The Best Forex Indicator

|

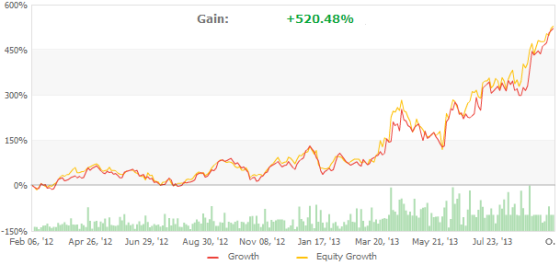

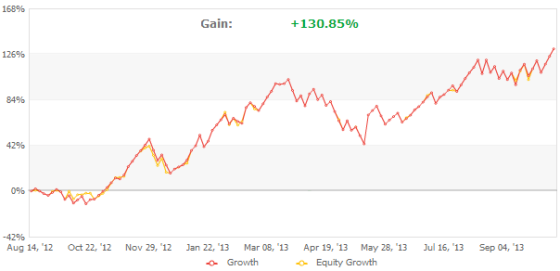

Forex21 Releases New Version of ProFX 3.0

Now ProFX3.0.6

Forex21

recently announced the release of the new version of ProFx 3.0. The

buy/sell signal trading utility has made up to 513.20% since its initial

launch in 2013

How It Works

The

semi-automated Forex trading system makes profitable trading as easy as

only possible. It continuously analyzes technical and fundamental

market conditions and provides you with precise entry and exit signals

through audio, e-mail and SMS notifications whenever a new high

probability setup has been detected. In summary it tells you when to

BUY, SELL, where to Set SL and TP Orders, when to Exit your Trades, when

and when Not to Trade, e.t.c.

New Features:

▪ Fixed bug in Multi Oscillator.

▪ Updated ProFx Swing Trading Template.

▪ Updated ProFx Intraday Trading Templates.

▪ Updated User Manual.

▪ Updated settings for WPR Indicator. ProFX

allows up to Five (5) Trading accounts, free build updates,

unconditional refund guarantee and special trade suggestions in user

forums

|

Swiss Central Bank Takes Off Cap On Franc

Extreme Gaps on CHF Causes Net Breaking Losses

|

| USDCHF 15th January, 2015 |

Shocking reports from the Swiss Central Bank's decision to stop the policy of capping the Swiss franc against the euro, sent the Swiss Franc to an unprecendented new level, which caused a wide gap on CHF pairs over 100ths of pips.

The

unexpected decision caused instant losses running into billions, and as

well profits for some traders who probably had open sell positions in

pairs like USDCHF.

According to Bloomberg.com, major dealers struggled

to process orders amid a flood of customer calls, and trade requests,

according to people with direct knowledge of the events. Some of these banks includes; Deutsche Bank AG (DBK), UBS Group AG (UBSG) and Goldman Sachs (GS) Group Inc.

The Swiss Franc grew 41% against the Euro and about 38% against the USD, but unfortunately

most investors couldn't take advantage of this because quotes were

frozen by brokers probably as a fail safe move thereby causing "No

Liquidity" in most platforms.

Most

financial experts believes that a higher than expected number of

traders were caught unawares in this frenzy move. Some brokers have

already begun sending emails informing their clients of their decision

to fill client orders and positions in other to fill the gap.

It

is likely that brokers with low holding capital might close up due to

the huge losses that will be involved after they bridge the gap.

Probably by next week we should be having a clear figure of this.

|

FXTradeCity Presents 20% Discount Special Offer

For ALL Quantina EA Products

& £90.00 Off for Opening A HotForex Zero Spread Account Through FXTradeCity

FXTradeCity Presents 20% Discount Special Offer

For ALL Quantina EA Products

& £90.00 Off for Opening A HotForex Zero Spread Account Through FXTradeCity

Due

to the closure of the pre-sale price of Quantina EA News Trader

Ultimate, FXTradeCity had to review the promo in the best interest of

traders. The pre-sale price of £149 is no longer valid as the price has

been adjusted to £190.

GET £90.00 OFF BUY AT £100.00

However traders can get a better deal when they open a HotForex Account (preferably Zero Spread Account) and get a unique coupon to purchase the EA for £100.00. Follow the steps below for this option;

- Open a HotForex Account through FXTradeCity by using this link: HotForex Zero Spread Account (Ideal for News Trading & Scalpers). Minimum opening deposit is $100

- Email us your HotForex ID.

- You will receive the unique Coupon Code to get the News Trader EA at £100.00

The 20% discount is still available for ANY Quantina products without opening a HotForex Account by using the unique Coupon Code:

VIPxcOnyeB

HOW QUANTINA EA WORKS

The

EA downloads the next news events from the

Forex Factory's website. If something goes wrong or the Economic

Calendar comes up late then the EA will contact Quantina's server, and

compare the correct news events, so you will never going to miss any

news events, especially the high

impacts news. A few seconds before the scheduled news release, the EA

selects the correct currency pair automatically and sets a buy stop

and sell stop orders. When the news released hits one of them (buy or

sell). EA will start to track it immediately, calculating with actual

spread and slips (version 2015 v3.1 and above) and sets the Safety

Net to the first profitable position (BreakEvenPips). You will earn at

least that much profit even if the market suddenly turns back.

However, if the market price moves forward in your favour, The EA will

track it, and handle your opened

position for the maximum profit. With spike trading method average

trading time is about 2-3 minutes. Average profit is about 1 - 25 pips /

trade.

(Average trading time 5-25 minutes, Average Profit 60pips/trade).

Advanced traders can use all the possibile trading methods at the same

time

on the same account which is highly profitable. Beginners are advised to

follow the

video instructions to reach high profit by monthly basis.)

FEATURES AND BENEFITS OF QUANTINA EA NEWS TRADER & OTHER PRODUCTS

- Fully

automated Forex

robot. It downloads the Economic Calendars, which are filtered

Automatically,

choosing the best possibility currency pairs and trading

automatically in the background to reduce internet usage. (no extra

chart will be opened) No restart needed after weekends.

- Low Start-up Cost: Minimum capital up to $400 & above, and $300 below for mini account.

- Advanced straddling method.

- About 82-90% consistency to achieve success in Forex trading.

- Can trade on EVERY Currency Pair 24 hours

from Monday to Friday simultaneously. One Running EA can open the

necessary major currency pairs in the background to reduce internet usage,

and reach better execution.

- Designed for ECN/STP accounts

- Varied Spread Tracking & Trail Before Break Even

- Automatic News Event Set

- Pending / Market Orders

- Max Spread Limit

- Next News Event Details

- Easy Installation and Set & many more......

Offer lasts from 10th January 2015 - 31st march 2015

Terms and conditions apply.

|

Forex Manipulation

More Bank Probe On The Way

Two (2) Major Banks on the Hit List

Reports

from financial sources (Bloomberg), on December 11, 2014 has it that

two (2) major banks are on the radar of New York's Financial Regulators

for alleged use of sophisticated algorithms in their trading platforms

to manipulate Forex prices.

According to Bloomberg's report the New York's Financial Services found likely evidence that Barclays Plc (BARC) and Deutsche Bank AG (DBK) may have used algorithms on their trading platforms to manipulate foreign-exchange rates, by using automated tools that goes beyond individuals colluding to rig currency

benchmarks, and take advantage of less sophisticated clients.

It is worthy to note that Deutsche Bank, and Barclays weren’t among the six firms that agreed to

pay $4.3 billion to U.S., U.K. and Swiss authorities last month in the

first settlements in the global probe.

Currently

monitoring systems have been installed in these banks as part of the

investigations as stated by a spoke person of the Financial

Investigating Authority.

It is highly expected that another round of penalties or fines might be the lot of these banks if found wanting.

|

HotForex FREE-For-All Holiday Tournament

$8,500 Cash Prizes + Gifts (Apple iOS Device)

Hotforex kicks off the holiday season with a FREE-For-All Demo Contest commencing 12th January, 2015. The

top 10 lucky winners would receive cash prizes ranging from $200.00 to

$2,500.00, while the first 3 winners would also receive Apple iOS

device. The 12 times industry award winner (HotForex) also stated that

participants would be allowed to use EAs for the contest. Registration for the contest starts 1st December 2014 - 11th January 2015

For more information on the breakdown of prizes, contest rules, and registration click here.

OTHER BONUS, SPECIALS, & PROMOTIONS FROM HOTFOREX

See details of some of these bonus on this page below

|

FXScam....Banks At It Again!!!

CFTC

Orders Five Banks to Pay over $1.4 Billion in Penalties for Attempted

Manipulation of Foreign Exchange Benchmark Rates. Total Penalties Since

June 2012 up to $3.4 Billion

A

shocking, and bizarre news came out officially from the Forex watchdog -

CFTC on November 12, 2014 stating penalties imposed on Five (5) notable

Banks for attempted manipulation of foreign exchange benchmark rates. The

shocking side of the story is the calibre of bank's involved -

Citibank, RBS, JPMorgan, UBS & HSBC. The statement alleged that

the heinous breach, which was carried out with other private banks

through a private chatting platform was aimed at manipulating the World

Markets/Reuters Closing Spot Rates (WM/R Rates), which is the most

widely referenced FX benchmark rates in the United States, and

globally. A

shocking, and bizarre news came out officially from the Forex watchdog -

CFTC on November 12, 2014 stating penalties imposed on Five (5) notable

Banks for attempted manipulation of foreign exchange benchmark rates. The

shocking side of the story is the calibre of bank's involved -

Citibank, RBS, JPMorgan, UBS & HSBC. The statement alleged that

the heinous breach, which was carried out with other private banks

through a private chatting platform was aimed at manipulating the World

Markets/Reuters Closing Spot Rates (WM/R Rates), which is the most

widely referenced FX benchmark rates in the United States, and

globally.

See details of the official press statement below:

"Washington, DC – The U.S. Commodity Futures Trading Commission (CFTC) issued five Orders filing and settling charges against Citibank N.A. (Citibank), HSBC Bank plc (HSBC), JPMorgan Chase Bank N.A. (JPMorgan), The Royal Bank of Scotland plc (RBS) and UBS AG

(UBS) (collectively, the Banks) for attempted manipulation of, and for

aiding and abetting other banks’ attempts to manipulate, global foreign

exchange (FX) benchmark rates to benefit the positions of certain

traders.

The Orders collectively impose over $1.4 billion in civil monetary

penalties, specifically: $310 million each for Citibank and JPMorgan,

$290 million each for RBS and UBS, and $275 million for HSBC.

The Orders also require the Banks to cease and desist from further

violations, and take specified steps to implement and strengthen their

internal controls and procedures, including the supervision of their FX

traders, to ensure the integrity of their participation in the fixing of

foreign exchange benchmark rates and internal and external

communications by traders. The relevant period of conduct varies across

the Banks, with conduct commencing for certain banks in 2009, and for

each bank, continuing into 2012.

Aitan Goelman, the CFTC’s Director of Enforcement, stated: “The

setting of a benchmark rate is not simply another opportunity for banks

to earn a profit. Countless individuals and companies around the world

rely on these rates to settle financial contracts, and this reliance is

premised on faith in the fundamental integrity of these benchmarks. The

market only works if people have confidence that the process of setting

these benchmarks is fair, not corrupted by manipulation by some of the

biggest banks in the world.”

According to the Orders, one of the primary benchmarks that the FX

traders attempted to manipulate was the World Markets/Reuters Closing

Spot Rates (WM/R Rates). The WM/R Rates, the most widely referenced FX

benchmark rates in the United States and globally, are used to establish

the relative values of different currencies, which reflect the rates at

which one currency is exchanged for another currency. FX benchmark

rates, such as the WM/R Rates, are used for pricing of cross-currency

swaps, foreign exchange swaps, spot transactions, forwards, options,

futures and other financial derivative instruments. The most actively

traded currency pairs are the Euro/U.S. Dollar, U.S. Dollar/Japanese

Yen, and British Pound Sterling/U.S. Dollar. Accordingly, the integrity

of the WM/R Rates and other FX benchmarks is critical to the integrity

of the markets in the United States and around the world.

The Orders find that certain FX traders at the Banks coordinated

their trading with traders at other banks in their attempts to

manipulate the FX benchmark rates, including the 4 p.m. WM/R fix. FX

traders at the Banks used private chat rooms to communicate and plan

their attempts to manipulate the FX benchmark rates. In these chat

rooms, FX traders at the Banks disclosed confidential customer order

information and trading positions, altered trading positions to

accommodate the interests of the collective group, and agreed on trading

strategies as part of an effort by the group to attempt to manipulate

certain FX benchmark rates. These chat rooms were sometimes exclusive

and invitation only. (Examples of the coordinating chats are attached

under Related Links.)

The Orders also find that the Banks failed to adequately assess the

risks associated with their FX traders participating in the fixing of

certain FX benchmark rates and lacked adequate internal controls in

order to prevent improper communications by traders. In addition, the

Banks lacked sufficient policies, procedures and training specifically

governing participation in trading around the FX benchmarks rates; and

had inadequate policies pertaining to, or sufficient oversight of, their

FX traders’ use of chat rooms or other electronic messaging.

According to the Orders, some of this conduct occurred during the

same period that the Banks were on notice that the CFTC and other

regulators were investigating attempts by certain banks to manipulate

the London Interbank Offered Rate (LIBOR) and other interest rate

benchmarks. The Commission has taken enforcement action against UBS and

RBS (among other banks and inter-dealer brokers) in connection with

LIBOR and other interest rate benchmarks. (See information below.)

The Orders recognize the significant cooperation of Citibank, HSBC,

JPMorgan, RBS, and UBS with the CFTC during the investigation of this

matter. In the UBS Order, the CFTC also recognizes that UBS was the

first bank to report this misconduct to the CFTC.

In related matters, the United Kingdom Financial Conduct Authority

(FCA) issued Final Notices regarding enforcement actions against the

Banks and imposing collectively penalties of £1,114,918,000

(approximately $1.7 billion), and the Swiss Financial Market Supervisory

Authority (FINMA) has issued an order resolving proceedings against and

requiring disgorgement from UBS AG.

The CFTC thanks and acknowledges the invaluable assistance of the

U.S. Department of Justice, the Federal Bureau of Investigation, the

Office of the Comptroller of the Currency, the Board of Governors of the

Federal Reserve System, the Federal Reserve Bank of New York, the FCA,

and FINMA.

CFTC Division of Enforcement staff members responsible for these

cases are Robert Howell, Jonathan Huth, Traci Rodriguez, Jennifer

Smiley, David Terrell, Melissa Glasbrenner, Heather Johnson, Jordon

Grimm, Elizabeth Streit, and Gretchen L. Lowe.

* * * * *

With these Orders, since June 2012, the CFTC has imposed penalties of

over $3.34 billion on entities relating to acts of attempted

manipulation, completed manipulation, and/or false reporting with

respect to global benchmarks. See In re Lloyds’ Banking Group, PLC , CFTC Docket No. 14-18 (July 28, 2014)($105 million)(CFTC Press Release 6966-14); (In re RP Martin Holdings Limited and Martin Brokers (UK) Ltd., CFTC Docket No. 14-16 (May 15, 2014) ($1.2 Million penalty) (CFTC Press Release 6930-14); In re Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. (Rabobank), CFTC Docket No. 14-02, (October 29, 2013) ($475 Million penalty) (CFTC Press Release 6752-13); In re ICAP Europe Limited, CFTC Docket No. 13-38 (September 25, 2013) ($65 Million penalty) (CFTC Press Release 6708-13); In re The Royal Bank of Scotland plc and RBS Securities Japan Limited, CFTC Docket No. 13-14 (February 6, 2013) ($325 Million penalty) (CFTC Press Release 6510-13); In re UBS AG and UBS Securities Japan Co., Ltd., CFTC Docket No. 13-09) (December 19, 2012) ($700 Million penalty) (CFTC Press Release 6472-12); In re Barclays PLC, Barclays Bank PLC, and Barclays Capital Inc., CFTC Docket No. 12-25 (June 27, 2012) ($200 million penalty) (CFTC Press Release 6289-12).

In these actions, the CFTC ordered each institution to undertake

specific steps to ensure the integrity and reliability of the benchmark

interest rates.

Media Contact

Dennis Holden

|

HotForex Launches 0.0 Spread Account

Barely

a month ago HotForex launched mouth watering bonuses, which saw new

clients getting FREE $30 credit in their accounts without any deposit

obligations and many other bonus. Click here to see more:

HotForex once again set a shocker recently by introducing a Zero Spread Account, targeting major currency pairs like the EURUSD and many others.

Here's the e-mail statement from HotForex:

"Dear Client,

In the recent

HotForex Survey, we asked you to tell us what you wanted us to do next. You

asked and we delivered! HotForex now offers you the best spreads in the

market with EURUSD starting at 0.0 PIPS!

Start trading Forex

with Raw Spreads from 0.0 Pips and Zero

Markups with the new HotForex Zero Spread

Account!

How It Works

With a HotForex Zero

Spread Account, you know that because there are no hidden charges or fees,

you will get the most competitive Forex spreads on the market

- HotForex receives prices from a pool of leading liquidity

providers.

- We pass those prices directly to you, our

Client, without adding any

markup.

- The HotForex Zero Spread Account offers a transparent commission

structure with rates as low as USD 0.04 per 0.01 lots, so all you will pay is a small, fixed commission on each

side of your trades.

Advantages of the

HotForex Zero Account

The HotForex Zero Spread

Account offers a low minimum deposit amount of just USD 100, putting deep,

institutional-grade liquidity within the reach of all traders! The account

features:

- No hidden markups

- Raw spreads from 0 pips

- Transparent, low-cost trading

- Trade on Interbank Spreads

- Competitive commission structure

- Minimum opening deposit USD 100

- Unlimited trade size

- Personal Account Manager

- Complimentary MYFX Platform for deposits over USD 2000

- Ideal for scalping, high-volume and automated trading"

To learn more about the features, and benefits of this offer click here then go to account types, and select Zero Spread Account

Open A HotForex Account Now

|

OFFER OF THE CENTURY

HotForex Launches Spectacular Bonuses in October 2014

HotForex recently announced the launching of mouth watering bonuses to start in the month of October, 2014.

The world acclaimed broker added that the new bonus would allow traders

to increase their leverage, earn rebates or protect their accounts from

drawdown. To the best of our knowledge all other existing bonus is

still in operation.

OFFER OF THE CENTURY

HotForex Launches Spectacular Bonuses in October 2014

HotForex recently announced the launching of mouth watering bonuses to start in the month of October, 2014.

The world acclaimed broker added that the new bonus would allow traders

to increase their leverage, earn rebates or protect their accounts from

drawdown. To the best of our knowledge all other existing bonus is

still in operation.

OFFERS IN THE BONUS:

100% Super Charge Bonus

Traders get to increase their leverage with a 100% Credit Bonus that can be applied to EVERY deposit of $200 to $250 or more. The maximum cumulative bonus that a trader can earn is a massive $50,000. This also includes daily CASH rebates to be earned through the trader's trading activity!*

$30 No Deposit Bonus

HotForex is offering a free $30 credit to new clients who want to experience trading in a real environment before investing their own funds. There is absolutely no obligation to deposit funds and profits can be withdrawn once the volume requirement has been met.* This simply means open an account and get it funded for FREE with $30.

Please note that terms and conditions apply*.

Open A HotForex Account Now

|

HotForex Launches New WebTrader Trading Platform

HotForex Launches New WebTrader Trading Platform

HotForex recently annoucned the launching of the renewed and improved version of one of their prolific web trading platform - WebTrader.

The platform which is highly customizable to trading

environment comes with latest update that brings

improved responsiveness and even better performance as stated by the developers. The WebTrader

interface has been automatically updated, so existing users only need to login to get access to the new features (Note: If you have any issues viewing

the new version, simply clear your cache).

New Features:

- NEW - Close all: Efficiently Close All open positions

by simply clicking one button.

- NEW - Redesigned User Interface: More user friendly

design to allow you to easily perform your Trade Operations

The update builds on WebTrader’s existing line-up

of benefits:

- Instant access – all you need is an internet connection.

- No download necessary

- Use your MT4 account login details

- Ability to open a position in WebTrader and close the same position on

the MT4 platform

- Enhanced charting functionality

- User-friendly interface

- Login to WebTrader using your HotForex

MT4 credentials.

Open A HotForex Account Now:

|

FOREX CLOUD SERVERS CANDLE FOREX VPS PROVIDER

POST INDEPENDENCE SPECIAL DISCOUNT & BONUS

CANDLE FOREX VPS PROVIDER

POST INDEPENDENCE SPECIAL DISCOUNT & BONUS

Candle Forex is offering a special discount on its Server Services between 7th and 14th

July 2014. All clients that places an order for any cloud server package will

get 20% off every month for the remainder of 2014.

To get this 20%

discount simply enter AMORPATRIAE at the check-out.

For those that are

interested or remember their Latin "AMOR PATRIAE" means "love of one's

country".

Existing clients who

already have a cloud server with Candle Forex can also get discounts too.

Special Bonus

Statement from Candle Forex.....

"The biggest 10 orders

for any service or product before 14th July will qualify for a 1 Troy oz

999 fine silver bar at *no* cost to you. This bar will either be a

highly-vaued 1983 Sharps and Pixley (with the original 1983 receipt) or a

similar highly valued and collectable silver bar dated between 1971 and

1983.

There are only 10 rare

bars available. Most of these silver bars are unavailable anywhere else to

buy because the mint has closed or were a limited circulation. These silver bars, if

your ever able to find them, usually retail for about $80 each!

Celebrate a "precious"

238 years of Independence!

Just remember to let

us know where to ship your bullion, and yes we will pay for the shipping

too!"

|

MQL SIGNAL SERVICES

HOTFOREX LAUNCHES MQL SIGNAL SERVICES ON MT4 MQL SIGNAL SERVICES

HOTFOREX LAUNCHES MQL SIGNAL SERVICES ON MT4

HotForex has announced the launching of the prestigious MQL Signal Services Tab on its platform.

Currently they are about 3,970 signals available for subscription in MQL Signal Services (See The Top 7 MT4 MQL's Signal Providers).

There

are very few Brokers who support the MQL Signal Services. This new

innovation by HotForex would allow traders to subscribe to any of the

signal services provider of their choice, and get automated placement of

trades to their platforms seamlessly.

Brief on Hotforex

HotForex is an award winning, fully regulated and licensed online Forex and commodities broker. Offers various accounts, trading software and trading tools

to trade Forex and Commodities for individuals, fund managers and

institutional customers. Retail, IB and White Label Clients have the

opportunity to access interbank spreads and liquidity via state of the

art automated trading platforms.

Headquartered in Mauritius and supported by their worldwide Customer Management Centre's,

HotForex offers its clients an unparalleled trading experience with

excellent multilingual support in an effort to provide its clients with

every advantage possible in order to facilitate their trading

activities.

HF Markets Limited, has a Category 1 Global Business License issued

by the Financial Services Commission (FSC) of the Republic of Mauritius

under the name of HF Markets Limited Company No.: 094286/GBL; Category 1 Global Business № C110008214 License. See more...

Benefits of HotForex

Earn twice when you, and your clients trade. Join the HotForex Affiliate Program and get up to $15 per lot commissions.

Live & Demo Contests with amazing cash prizes....

Variable bonus offers....

Tight Spreads...

Tight Spreads...

A smarter, safer and transparent PAMM System.

A smarter, safer and transparent PAMM System.

and many more....

and many more....

|

The much awaited Forexpeacearmy's 2013 Forex Broker Scam of the year was released on Friday 18th April, 2014. The

FPA has a reputation for unbiased benchmark and review of Forex

products and services. The yearly contest was designed to serve as a

deterrent to deceitful brokers, ensure fair-play, and to keep traders

informed.

Here are the top 4 worst brokers in 2013:

Rank No 4: (HFX.com)

Apart

from failing to pay their client (traders) debts, this broker was known

for posting fake reviews about their services, and wiping off their

client accounts after assuring to place profitable trades and many more....

Rank No 3: (Forexoma.com)

The once Forex

education, signal provider, and trading systems site owned by Vahid

Chaychi were accused of taking away their client funds. At a particular

time their

website went down and the complaints for withdrawal issues among others

increased. In no distant time their MT4 server went down and the

complaints skyrocketed. Read more...

Rank No 2: (Liteforex.com)

This

broker cleverly used their terms of service to limit their clients from

making legitimate profits in their trades especially with news trading. This gave them arbitrary power to impound client funds for no legitimate reasons.

Rank No 1: (4XP.com)

4XP picked the worst of the worst broker in 2013.

For the complete story of the 2013 Forex Broker Scam of the Year please click here

Do you think you have been scammed? Submit your complaint with the FPA or contact us to assist you.

|

Report

on Monday 31st March, has it that the following banks: Royal Bank of

Scotland, Credit Suisse, Zuercher Kantonalbank (ZKB), Barclays Bank,

Citigroup, JP Morgan, UBS, and Julius Baer are on the radar of the

Swiss Competition Authority probe panel for alleged collusion to

manipulate exchange rates in foreign currency trades.

A

crucial part of the watchdog’s examinations are to ascertain whether

traders from different banks teamed up to induce currency prices, and

whether they traded ahead of their own customers or failed to accurately

represent to customers how they were determining the prices.

A

statement credited to the Switzerland's Competition Commission WEKO, on

Monday states that it had opened an investigation into the Swiss,

British and U.S. banks over potential conspiracy to manipulate foreign

exchange rates of which the most important exchange rates were affected.

A similar preliminary investigation last October was opened by the

Swiss Competition Authority after gathering facts about potential

manipulation of foreign exchange markets by banks.

Previous

investigations of this sort by international investigating agencies had

led to huge fines to errant banks. Also last week, UBS suspended

several currency traders, pending international investigations into

allegations of collusion and market rigging.

In

reaction to these allegations, some of the banks penciled in the

statement were shocked at WEKO's action because they were not given

advance notice prior to the release of these allegations to the public.

Julius

Baer said an internal investigation had found no evidence of foreign

exchange market abuse behavior. Credit Suisse in their reaction found

the allegation as “astonishing” and further stated that WEKO's press

release contained inappropriate references to Credit Suisse AG and that

the claims were "inappropriate and harmful" to its reputation.

Meanwhile UBS, JP Morgan, RBS and Citigroup have not made any public statement on WEKO’s action as at the time of the release.

According

to reports from Reuters, the Swiss Competition Authority would conduct

the investigation by themselves without the interference or assistance

of foreign authorities due to legal reasons.

If

these banks are found culpable then they would like face fines up to

10% of their turnover generated in the relevant market in Switzerland

over the last three years.

A

major concern for Forex traders is that these banks are the custodians

of client funds for major Forex brokers. Therefore a lot could be at

stake for the banks and other institutions like the Forex Brokers with

regards to client confidence on the Broker's Bank integrity.

|

The developers of StrategyQuant has upgraded their computer generated strategy platform to 3.5. The new release was announced on their website on 21st Feb, 2014.

A key feature of this release is its cross compatibility to generate trading strategies for the NinjaTrader Platform.

See excerpts of the new features in version 3.5:

- Support for Ninja Trading Platform.

- An optional functionality to divide the history data to three parts - training, validation, and out of

sample. This enables better control of the evolution

analysis.

- Improved the Walk-Forward optimization speed.

- Walk-Forward success criteria is now fully dynamic.

- Speed enhancements on virtually all areas of the program. Backtest now run much faster at speeds 2x - 5x.

- Added new indicators like Pivots, and a new conditional operator that checks if price closes above/below a given value.

- Fixed compatibility issues with MT4 Build 600 and 604 (NB: MT4 Build 610 was probably released after V3.5)

Fixed bugs and errors in data import, strategy loading, testing, displaying results, etc.

Promo Offer

To celebrate the new release, StrategyQuant is offering a special 30% discount off the regular price! Offer expires 11:59:59 pm PST on Monday February 3rd, 2014.

Also see StrategyQuant's Tick Data Downloader new version 2.0 To celebrate the new release, StrategyQuant is offering a special 30% discount off the regular price! Offer expires 11:59:59 pm PST on Monday February 3rd, 2014.

Also see StrategyQuant's Tick Data Downloader new version 2.0

|

|

MetaQuotes has upgraded its previous MT4 Build 509 to Build 600, which is close to an exact replica of MetaTrader 5.

MT4

Build 600, which was officially released on 3rd February, 2014 comes

with massive changes that seemsto be a deliberate transition from MT4 to

MT5. Traders who downloaded the new build have witnessed strange

changes in the new build especially with regards to EAs, File Structure,

and Development of EAs/Indicators. The new build somewhat closes the

gap between MT4 and MT5, thereby making it quite difficult to

differentiate. MetaQuotes has upgraded its previous MT4 Build 509 to Build 600, which is close to an exact replica of MetaTrader 5.

MT4

Build 600, which was officially released on 3rd February, 2014 comes

with massive changes that seemsto be a deliberate transition from MT4 to

MT5. Traders who downloaded the new build have witnessed strange

changes in the new build especially with regards to EAs, File Structure,

and Development of EAs/Indicators. The new build somewhat closes the

gap between MT4 and MT5, thereby making it quite difficult to

differentiate.

See: Difference Between MT4 and MT5 Before New Build 600

Although

MetaQuotes has assured that the key elements of MT4 Build 509 would not

be affected in the new build. But only time would tell.

Please see the following new features and likely uncertainties before you upgrade or download the new build.

New Features (Build 600):

- Store

of trading applications has been added. This includes about 200 EAs,

Indicators & other products that can be downloaded right from

the platform

- MetaTrader Market which was only found in MT5 is now included in the new build.

- A unified Meta Editor Development has been created for development of EAs on MT4/5 along side with a unified compiler that automatically supports both MQL4 and MQL5 languages.

- EX4 codes are compatible with the new build. No need to recompile them. However some EA developers are on the edge on this.